Dow Jones Future drops to 300 points while SGX Nifty down 110 points.

Buy on deeps as it’s expiry do not trade too short

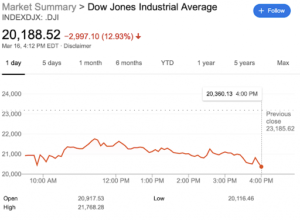

Dow Jones Just Crashed 3000 Points – News

Top Picks – List of Quality Stock worth buying in every fall – 13-Mar-2020

YES Bank to target single digit – Sell Yes Bank at any level – 06-Mar-2020

Old tax slabs are more beneficial than new tax slabs?

Here are our comparison between old and new tax slabs. If you are earning less or high, if you are saving max in all exemptions then you should continue with old tax slab.

| Your Income | 1000000 | 1000000 | ||||||

| Deductions | ||||||||

| 80C | 150000 | |||||||

| 80CCD | 50000 | |||||||

| 80D | 25000 | |||||||

| House Loan | 200000 | |||||||

| Standard Deduction | 50000 | |||||||

| 525000 | 1000000 | |||||||

| Tax To be Paid | ||||||||

| 0 | 250000 | 0 | 0 | 0 | 0 | |||

| 250000 | 500000 | 5 | 12500 | 5 | 12500 | |||

| 500000 | 750000 | 20 | 5000 | 10 | 25000 | |||

| 750000 | 1000000 | 20 | 0 | 15 | 37500 | |||

| 1000000 | 1250000 | 30 | 0 | 20 | 0 | |||

| 1250000 | 1500000 | 30 | 0 | 25 | 0 | |||

| above | 1500000 | 30 | 0 | 30 | 0 | |||

| Tax Payable | 17500 | 75000 | ||||||

| Your Income | 2000000 | 2000000 | ||||||

| Deductions | ||||||||

| 80C | 150000 | |||||||

| 80CCD | 50000 | |||||||

| 80D | 25000 | |||||||

| House Loan | 200000 | |||||||

| Standard Deduction | 50000 | |||||||

| 1525000 | 2000000 | |||||||

| Tax To be Paid | ||||||||

| 0 | 250000 | 0 | 0 | 0 | 0 | |||

| 250000 | 500000 | 5 | 12500 | 5 | 12500 | |||

| 500000 | 750000 | 20 | 50000 | 10 | 25000 | |||

| 750000 | 1000000 | 20 | 50000 | 15 | 37500 | |||

| 1000000 | 1250000 | 30 | 75000 | 20 | 50000 | |||

| 1250000 | 1500000 | 30 | 75000 | 25 | 62500 | |||

| above | 1500000 | 30 | 7500 | 30 | 150000 | |||

| Tax Payable | 270000 | 337500 |

SBI Cards and Payment Services Ltd IPO Launch Date Price GMP Details

Nikkei nears 3-month low after US data spurs selling : Moneycontrol

Japan’s Nikkei stock average fell on Tuesday morning, hitting the lowest level in almost three months, after disappointing US manufacturing data cast a pall over Wall Street.

The benchmark Nikkei shed as much as 3.4 percent to 14,121.05 before steadying to end the morning session 2.62 percent down at 14,236.59.

After its stellar gains of 57 percent in 2013, the Nikkei has dropped 12.6 percent since the start of this year to become one of the worst performing markets.

“What is of concern is that there appears to be a substantial overhang of foreign ownership in the Japanese stock market,” said Stefan Worrall, director of equity cash sales at Credit Suisse in Tokyo.

In a major bearish signal for chartists, the Nikkei fell decisively below its 200-day moving average, around 14,425, for the first time since November 2012 when the market started rallying on expectations of radical monetary easing.

“Many market players are trying to determine whether the recent declines are just a short-term correction or a change of tide in the market,” said Kenichi Hirano, a strategist at Tachibana Securities.

But global investor sentiment was rocked by US data showing manufacturing activity slowed sharply in January on the back of the biggest drop in new orders in 33 years, while construction spending barely rose.

On Wall Street, the S&P 500 suffered its worst drop since June.

On the Nikkei, index heavyweight SoftBank Corp plunged as much as 5.8 percent at one point, adding to its 6.6 percent decline in the previous session, before bargain-hunting by retail investors forced a sharp rebound.

The stock was the most traded stock on the main board and last traded up 2.6 percent on the day, though it was still down more than 20 percent so far this year.

Other names with high foreign ownership also took a beating. Mazda Motor Corp fell 5.4 percent.

Currency-sensitive exporters came under pressure as the yen rose to 2 1/2-month high on safe-haven buying.

Toyota Motor Corp , which will announce its quarterly earnings results after the market closes, dropped 4.5 percent and was the third-most traded stock by turnover on the Topix.

Aside from Toyota, several major companies, including Panasonic Corp , Sharp and Hitachi Ltd are set to announce quarterly results later in the day. Nippon Paint Co Ltd nosedived as much as 14.9 percent on dilution concerns after the paintmaker said it would issue new shares.

The broader Topix index was down 3.1 percent at 1,159.29 in heavy trade, with volume at 85.1 percent of the fully daily average for the past 90 trading days.

The JPX-Nikkei Index 400 , an index launched this year comprised of firms with high return on equity and strong corporate governance shed 3 percent to 10,509.44.

Courtesy : http://www.moneycontrol.com/news/asian-markets/nikkei-nears-3-month-low-after-us-data-spurs-selling_1037107.html

Honda to launch 3 new models in India : BusinessLine

After a brief lull, Japanese carmaker Honda Motor Co Ltd is preparing for a big comeback into India’s passenger car segment.

On the anvil is the launch of three cars that will join the company’s existing portfolios by the end of 2014-15. One of them will be the much-anticipated Mobilio compact family van.

Talking to reporters from the Asian region on the sidelines of the Tokyo Motor Show, Honda Motor Co CEO Takanobu Ito and Yoshiyuki Matsumoto, President & CEO of Honda Motor India, said the company will launch the three cars in quick succession. The Mobilio, which will be most suitable for markets such as Indonesia, will also cater to the emerging utility vehicles segment in India, they said.

The Mobilio will take on the likes of the Maruti Ertiga, the Chevrolet Enjoy and the Nissan Evalia. The multi-purpose vehicle is based on the Brio platform and will likely be offered with both diesel and petrol engines.

The other two cars that would also be rolled out in the next few months are the new City and the Jazz models. While the fourth generation City will be launched in two weeks, the new Jazz will probably make it to showrooms by early 2015.

Besides, the company will look to expand its R&D team in India, with the objective of building a completely made-for-India and made-in-India car.

“We are aware that the Indian market is a very large small car market. The next Brio series or the next Jazz could be the small cars that might be developed locally for the Indian market. We want to identify the specific needs of the Indian customers. We do plan to complete a full-fledged R&D facility there for the purpose of doing local research and model development activity,” said Matsumoto, who is also the MD and representative of development, purchasing and production (Asia and Oceania).

Essentially, this means that Honda could launch a completely locally developed small car within three to five years.

A new version of the Jazz or the Brio that takes into account the price sensitivities and local preferences of Indian customers can be developed earlier than that.

Perhaps, Matsumoto’s confident comment – “Please keep your expectations high” – stems from the strong performance recorded by the new Amaze sedan, which has enabled Honda to take on the Maruti juggernaut.

Driven by the Amaze, Honda has nearly doubled its market share in India from about 2.8 per cent to about 5 per cent. Honda is targeting sales of 1.2 million cars from the Asia-Oceania region by 2016-17, with India contributing almost 300,000 units.

Honda Cars India can easily look at doubling of its current production capacity with the option of assembling cars at its second plant in Tapukara, Rajasthan. Its first unit is located in Greater Noida, Uttar Pradesh, with an installed capacity of one lakh units a year.

Courtesy : http://www.thehindubusinessline.com/companies/honda-to-launch-3-new-models-in-india/article5374796.ece

Article By : S. Muralidhar

BHEL bags order worth Rs 1300 crore from NBPPL : Indian-commodity

State-owned heavy equipment maker, Bharat Heavy Electricals (BHEL) has bagged order worth Rs 1,300 crore from NTPC BHEL Power Projects (NBPPL), a joint venture between NTPC and BHEL for the supply and installation of the Steam Generator, Steam Turbine Generator and Electrics Package for the upcoming 500 MW Feroze Gandhi Unchahar Thermal Power Project (TPP).

BHEL’s scope of work in the contract envisages design, engineering, manufacture, supply and erection & commissioning of Steam Generator, Steam Turbine Generator and their auxiliaries; Electrics and Switchyard with associated Civil Works along with state-of-the-art Controls & Instrumentation (C&I). The order reinforces BHEL’s leadership status in the execution of thermal power projects involving supply of state-of-the-art equipment, suited to Indian coal and Indian conditions.

More than 100 numbers of 490-600 MW rating thermal sets have been contracted by BHEL in the country so far, of which 45 sets have been contracted for projects of NTPC and its JVs. On commissioning of the unit, 12 million units of electricity will be added to the grid, every day.

BHEL has been committed to the nation’s power development programme and has reaffirmed its commitment to the Indian Power Sector by equipping itself by way of contemporary technology, state-of-the-art manufacturing facilities and skilled technical manpower. Significantly, the company has established the capability to deliver power plant equipment of 20,000 MW per annum.

Courtesy : http://www.indian-commodity.com/corporate/bhel-bags-order-worth-rs-1-300-crore-from-nbppl.aspx

Vedanta commissions world’s first red mud powder plant : MoneyControl

Vedanta Aluminium Ltd (VAL) has commissioned a red mud powder producing unit at Lanjigarh refinery in Odisha, describing it as first of its kind in alumina industry tackling major environmental hazards. “The unique project of producing red mud powder has been commissioned in a fully mechanised and automatic plant. The system has been developed in-house after continuous research for more than three years,” a senior company official said in a statement today. Giving details of the project, Mukesh Kumar, president and COO of VAL said the project which was commissioned last week is the first of its kind in the world and has been set up with a capital expenditure of around Rs 50 crore. This will have advantages like savings in caustic consumption by 10-15 kg per tonne of alumina, minimising land requirement by 50 to 60 per cent, and doing away with wet red mud storage thereby eliminating environmental hazards, he said. The powdery red mud can easily be utilised in cement industry as well as in other Industries, Kumar said. Red mud is a waste from alumina industry and its disposal and utilisation has always been a matter of concern for environmentalists as well as alumina industry. Also read: Vedanta aims to triple capacity despite alumina shortage Although, the alumina technology is more than 100 years old but no solution could be evolved by the industry to avoid storage of red mud slurry, sources said. As the slurry is alkaline in nature and its generation is nearly one and a half times of alumina, world over millions of tonnes of red mud is lying in various red mud ponds except in some countries where it is discharged into the sea. In any alumina refinery, a major portion of land is used for handling this waste. Although, red mud is rich in iron and titanium, no use could be made till now mainly due to presence of caustic soda. Looking into the serious nature of hazard such red mud ponds may have, MoEF has formed a special project only few months back as National Mission for Red Mud to sponsor and promote research in red mud utilisation, sources said.