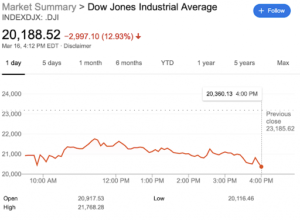

Dow Jones plunges 13 per cent as coronavirus sell-off intensifies on Wall Street and Donald Trump warns of US recessionUS stocks ended sharply lower on Monday, with the Dow posting its worst point drop in history and falling to its lowest level in nearly three years. Worries mounted that central banks’ emergency measures over the weekend meant the economy is in much worse shape than previously believed.The Dow Jones index dropped 2999 points, or 12.9%, to 20187. The latest plunge wiped out three years’ worth of gains, with Dow investors back to where they started if they began investing in February 2017. This was also the worst day since the 1987 “Black Monday” crash, when the industrial-skewed index shed nearly 23 per cent of its value in a single day. The other major indices did not fare much better. The benchmark S&P 500 dropped 12 per cent to 2,386 points, and the tech-heavy Nasdaq fell 12.3 per cent to 6,905. Stocks tripped a circuit breaker at the New York open, with the S&P 500 (SPX) falling more than 7%. Trading was halted for 15 minutes. Steep losses accelerated in the last half hour of trading after Trump said the economy may be headed for a recession, urging people to avoid large gatherings of 10 or more people. Shockingly, this is the third time in a week circuit breakers were set off on the trading floor as the impact of the virus escalates.

These measures halt trading during excessive market drops.

When it drops by 7 or 13 percent, trading will stop for 15 minutes.

But when the market plunges to a Level 3 with a 20 percent freefall, trading stops for the entire day.

A rebound later in 2020 could be aided by extreme steps taken by global central banks to restore confidence and keep markets functioning.The Federal Reserve has embarked on two emergency rate cuts this month, including one late Sunday that sent rates back to zero. The Fed has also promised to pump in trillions of dollars of cash into financial markets and relaunched its 2008 crisis-era bond buying program known as quantitative easing.

Goldman Sachs warns US stocks could plunge another 16% before rapidly recovering. Goldman Sachs is warning clients that the S&P 500 could bottom at 2,000 by midyear, marking a 41% plunge from the record highs set just a month ago. The Wall Street bank expects stocks to rapidly recover before the end of the year.

Almost nothing was left unscathed — even safe-haven assets like gold dropped 0.9 per cent to $US1,503.50 an ounce. Investors seeking a safe-haven in precious metals will be sorely disappointed in gold’s performance. It shed 1.75%, while silver sunk 12% into the $12 handle. Oil, already slammed by a price war between Russia and Saudi Arabia, slumped to less than $US30 a barrel in early trading to lows last seen in early 2016.

There was further policy easing on Monday from the Bank of Japan, in the form of a pledge to ramp up purchases of exchange-traded funds and other risky assets. |